• Infinite Banking is a blend of spenders, savers, borrowers, & bankers all at once! We become the bank!

• Instead of all our income going toward our monthly bills which include a mortgage, our utilities, food, gas, etc., like we have been taught to do, we added just one step to the process and changed where that money goes before it can be spent anywhere else.

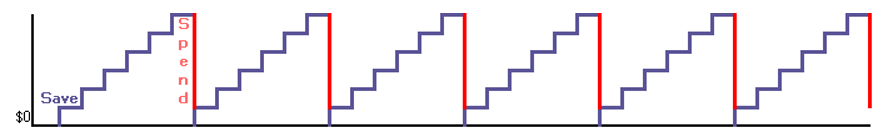

• We put money into our Infinite Banking policy. That’s our “bank”. It’s where we store wealth. Question: If this was your “bank”, would you want your deposits to be small or large? You would want them to be as large as possible.

• Your money must reside somewhere. Rather than keeping it in a bank where it earns nothing, we put it into our whole life policy where it gets a competitive return and grows tax exempt. Hey, if you’re getting a competitive return to start with… AND we are not taxed on its growth is that better than most everything else out there? But we don’t just keep it there. We use it! (And we multiply it as I will describe in another article).

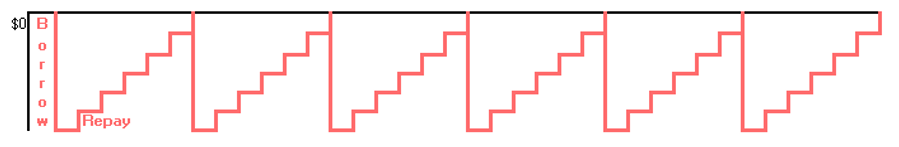

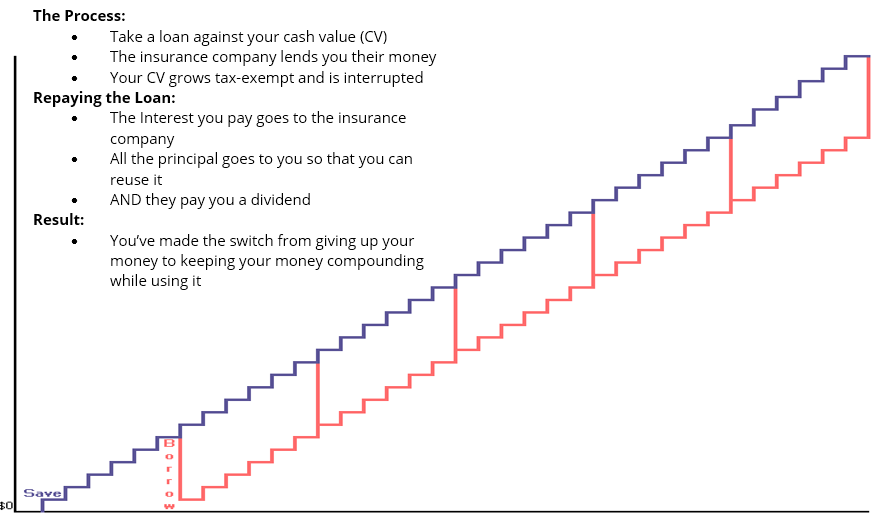

• The process is: We take a loan against our cash value, plop it into our bank so we can write a certified cheque and pay cash for our vehicle. Then, when I get around to it, I repay my policy. I set it up to pay all the principal back to me so I can use it again. All the interest goes to the insurance company. All the principal goes to me… AND they pay me a dividend.

• We get multiple uses out of one dollar: We get a death benefit, we create a pool of capital that grows and compounds tax-exempt so that it will be there to supplement our retirement, and when we borrow against our cash value, it continues to grow and compound without missing a beat as though we hadn’t touched a loonie of it.

• So, you’ve received the benefits of what you’ve used that money for now, and it will be paid off when you die.

• You’ve moved from a middle-class mindset: “I drained my bank account for a purchase” and moved to a wealthy mindset: “How can I make that purchase and get my money back”?

• You’ve made the switch from giving up your money, to NOT giving up your money for anything, ever! You are now treating your cash as capital and when we understand what capital can do for us, we never want to part with it!

• That's what banks do, and that’s what your policy allows you to do. When we don’t do it, it feels like we are stealing from ourselves.

• It does not contribute to inflation.

• I WIN! You WIN! We ALL WIN!